Introduction to repurchase agreements

A repurchase agreement (repo) is a short-term financial transaction between two parties, typically a financial institution and another entity such as a corporation, government agency, or another financial institution. In this transaction, one party sells securities to the other party with an agreement to buy them back at a later date.

In repo transaction, the buyer is essentially lending money to the seller in exchange for collateral in the form of securities.

Therefore is also sometimes called a secured loan.

Here’s how it works:

- The seller sells securities, to the buyer for a specified amount of money, usually at a discount.

- The buyer pays the seller for the securities and holds them for a predetermined period, which can range from overnight to several weeks or even months.

- At the end of the agreed-upon period, the seller buys back the same securities at a slightly higher price.

- The buyer returns the securities to the seller and receives the premium on top of their original investment.

Here seller sometimes called lender or someone doing the reverse repo.

A repo has two legs:

- the near leg is the sale of a security by the borrower to the lender with an agreement to repurchase it later

- the far leg is the longer-term repurchase of the security by the borrower from the lender.

The interest rate on the repo is based on the price difference between the near and far legs. The near leg provides short-term funding to the borrower, and the far leg is the repayment of the loan.

Repos are commonly used by financial institutions, including banks, as a way to manage their liquidity and meet regulatory requirements. They are also used by government agencies and other entities as a way to finance their operations, but mainly used by dealers in government securities.

Repos are generally considered to be low-risk investments because the securities being used as collateral are highly liquid and have a low chance of default. However, like any financial transaction, there is some degree of risk involved, and the parties involved must carefully manage the terms of the agreement to ensure that they are able to meet their obligations.

Bilateral repo vs Tri-party repo

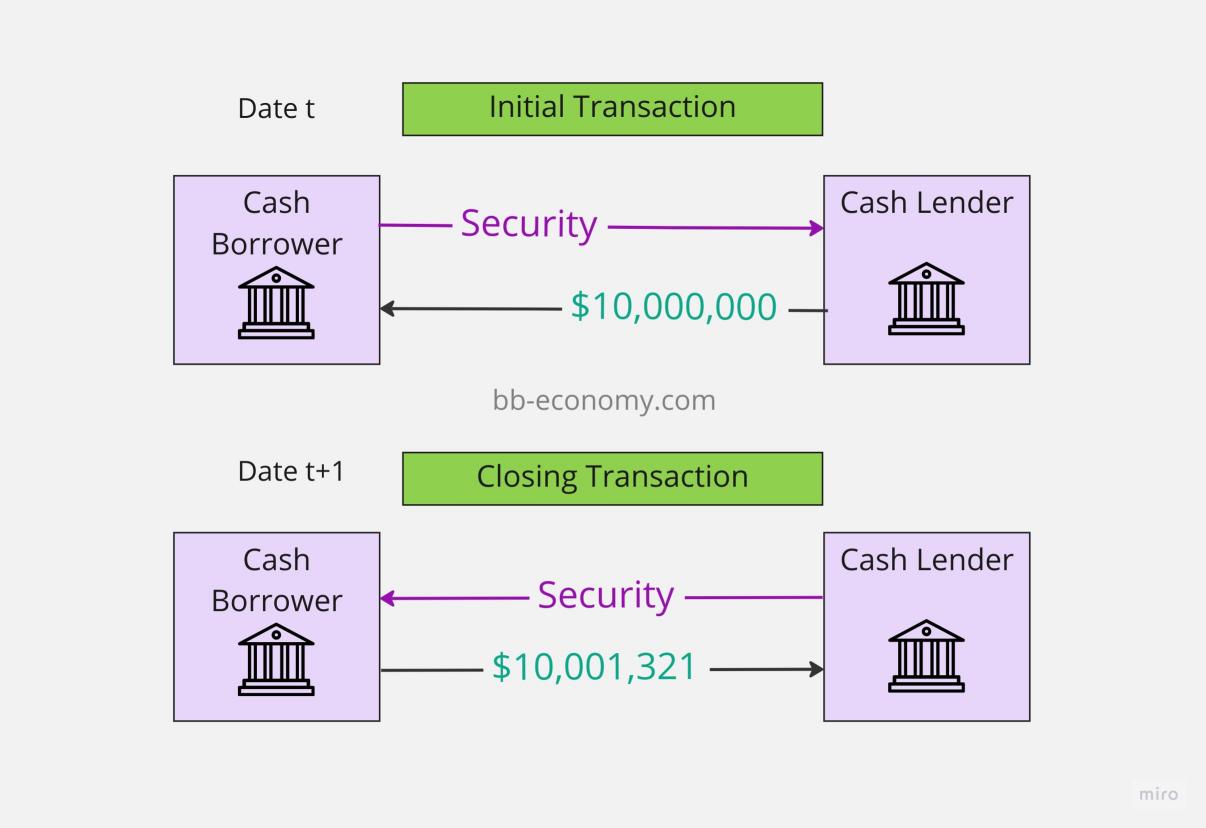

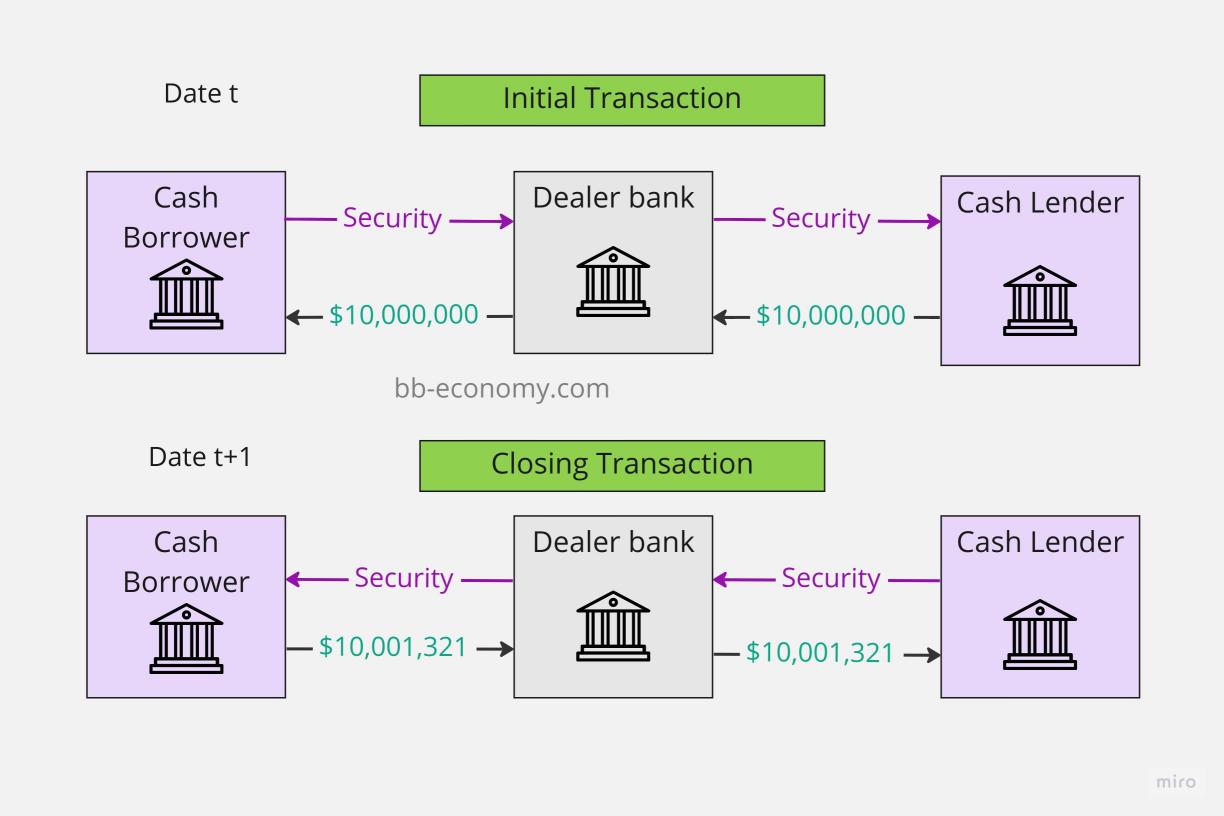

The two types of repo transactions, those executed through a dealer bank and those executed directly between counterparties.

A repo transaction executed through a dealer bank is commonly referred to as a “tri-party repo,”. The dealer bank acts as a facilitator of the transaction, providing operational and credit support, such as settling the trade and managing the collateral. Tri-party repos are commonly used by smaller financial institutions or those with less operational capacity, as they can rely on the dealer bank for these services.

tri-party repo schema

tri-party repo schema

A repo transaction executed directly between counterparties is commonly referred to as a “bilateral repo,” because there are only two parties involved in the transaction: the buyer and the seller. Bilateral repos are typically executed between larger financial institutions, such as banks or securities dealers, that have the infrastructure and expertise to manage the operational and credit risks associated with the transaction.

Both tri-party and bilateral repos are important tools for managing liquidity and funding in the financial markets, but the choice of which type of repo to use will depend on the size and complexity of the transaction, as well as the operational capacity of the parties involved.

Direct repo transactions are less common than repo transactions executed through a dealer bank because they require a higher level of infrastructure and expertise.

Repo Haircut

Repo Haircut refers to the percentage of reduction in the market value of the security used as collateral for the loan. For example, if a security is worth $100 in the market, and the lender requires a 10% haircut, the collateral value of the security for the loan would be $90.

The size of the haircut depends on various factors, including the creditworthiness of the borrower, the liquidity and volatility of the security being used as collateral, and the length of the loan term. The higher the perceived risk associated with the borrower or the security, the higher the haircut may be.

Haircuts are used to protect lenders from potential losses in the event that the borrower defaults on the loan or the value of the collateral falls below the amount of the loan. By requiring a haircut, lenders can reduce their exposure to risk and ensure that the value of the collateral is sufficient to cover the loan amount in the event of a default.

RP vs RRP

Repo and Reverse repo also by professionals shorten to RP or RRP do describe the perspective on the same type of transaction.

The borrower sells the assets and agrees to repurchase them in the future. Hence, from the perspective of the borrower, the agreement is one of “repurchase” RP.

The lender first buys the assets and agrees to sell them in the future. As we can see, this is the opposite of repurchase and hence it is called a reverse repurchase agreement or RRP.

Consider an example where a treasury dealer sells treasuries to the commercial bank with an agreement to repurchase them at a future date. From the perspective of the dealer, this transaction is one of repurchase while from the perspective of the bank it is a reverse repurchase transaction.

Overnight Reverse Repurchase Agreements

An overnight reverse repurchase agreement (Known as ON RRP) typically referred to one between the Federal Reserve and financial institutions such as banks or money market funds. In this transaction, the Federal Reserve sells securities to the financial institution with an agreement to buy them back the next day at a slightly higher price.

In this transaction, the financial institution is essentially lending money to the Federal Reserve overnight. The Fed would sell securities, such as U.S. Treasury bills or bonds.

How does Fed uses ON RRP

The Federal Reserve uses Overnight Reverse Repurchase Agreements (ON RRP) as a monetary policy tool to help manage short-term interest rates in the economy. The Effective Federal Funds Rate (EFFR) is a key benchmark for short-term interest rates in the US economy.

The Federal Open Market Committee (FOMC) sets the target range for the EFFR, and uses a range of monetary policy tools, such as open market operations and ON RRP, to influence the supply of reserves in the banking system and keep the EFFR within its target range.

- When the Federal Reserve wants to decrease short-term interest rates, it typically engages in open market operations, buying securities from banks and other financial institutions, which injects cash into the banking system and lowers interest rates.

- Conversely, when the Federal Reserve wants to increase short-term interest rates, it sells securities to these institutions, removing cash from the banking system and raising interest rates.

However, there is a limit to how low the Federal Reserve can push short-term interest rates by buying securities. At a certain point, the market demand for these securities becomes saturated, and buying more securities will no longer push interest rates down. This is where ON RRP comes in.

ON RRP provides an alternative for financial institutions to invest their excess cash overnight, with the Federal Reserve acting as a counterparty. By selling securities to financial institutions in exchange for cash overnight, the Federal Reserve can drain excess cash from the banking system and raise short-term interest rates.

In summary, the Federal Reserve uses ON RRP to manage short-term interest rates when traditional open market operations are not sufficient to achieve its policy objectives.

ON RRP Award Rate

The Overnight Reverse Repurchase Agreements (ON RRP) Award Rate is the interest rate paid by the Federal Reserve to eligible participants on ON RRP.

The eligible participants are:

- Fed’s Primary Dealers

- additional RRP Counterparties

In recent time the Award rate was 0,05% above lower bound of Target Funds Rate

Repo Rate and Federal Funds Rate

Interbank repos are short-term borrowing and lending agreements between banks that are used to manage their daily cash flows and reserve requirements. In an interbank repo, one bank borrows cash from another bank by selling securities, such as government bonds, to the lending bank with the agreement to repurchase them at a later date, typically overnight.

The interest rate charged on these interbank repos is called the repo rate. In effect the repo rate between banks is described by the Effective Federal Funds Rate, which is the interest rate at which banks lend to each other overnight to meet their reserve requirements.

Repo Markets overview

Repurchase agreements are not used just by the Federal Reserve but widely in the financial markets where the short-term funding and liquidity demands may exist.

Here some commonly known:

-

Commercial banks: Banks use repos to manage their short-term funding needs and maintain sufficient liquidity. Banks may borrow funds from other banks or financial institutions using a repo, and then use the funds to make loans or invest in other securities.

-

Money market funds: Money market funds use repos to generate income and maintain liquidity. They lend cash to other financial institutions, such as banks or investment firms, in exchange for collateral, typically government securities or other high-quality bonds.

-

Securities dealers: Securities dealers use repos to finance their inventory of securities. They borrow cash from other financial institutions, such as money market funds, using the securities as collateral, and then use the cash to purchase more securities.

-

Central Banks: Same as Fed other also European Central Bank (ECB) and the Bank of Japan (BOJ) use repos to provide short-term liquidity to banks and financial markets.

In general, repurchase agreements are used by any institution that needs short-term funding or wants to earn a return on excess cash holdings. The terms and conditions of the repo will vary of course.

Repo Strategies

Institutions use a variety of strategies to manage liquidity and risk when engaging in repos. Here are some examples of strategies commonly used:

-

Collateral management: One of the primary risks in a repo transaction is the risk of default by the counterparty. To mitigate this risk, institutions carefully manage the collateral used in the transaction. They typically require high-quality collateral, such as government securities or highly rated corporate bonds, and may require additional collateral to be posted if the value of the securities used as collateral declines. Institutions also monitor the creditworthiness of their counterparties to ensure they have sufficient liquidity to meet their obligations.

-

Duration management: Institutions may use repos to manage the duration of their portfolios. For example, a money market fund may use a repo to lend cash for a short period, such as overnight, in exchange for government securities that mature in the same time frame. This helps the fund maintain a stable net asset value (NAV) and manage interest rate risk.

-

Liquidity risk management: Institutions may use repos to manage their liquidity needs. For example, a bank may use a repo to borrow cash for a short period, such as one week, to fund its operations. This allows the bank to maintain sufficient liquidity to meet its obligations and manage its cash flows.

-

Regulatory compliance: Institutions must comply with a variety of regulations when engaging in repo transactions, such as capital requirements and reporting requirements. Institutions may use repo transactions to manage their regulatory compliance, such as by managing their balance sheet and capital ratios.