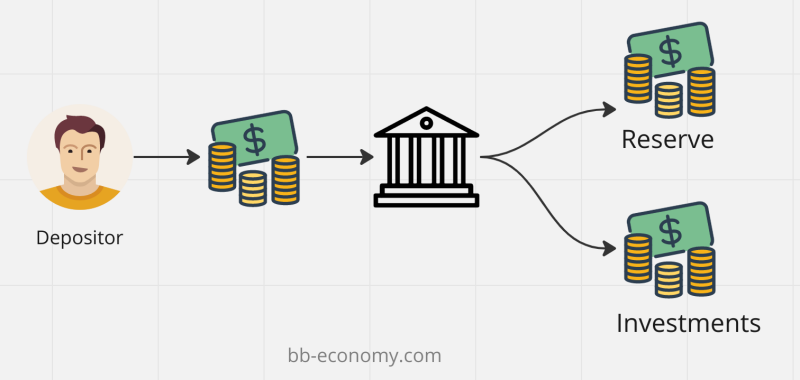

In order to understand how the money is actually created let’s break down the modern banking system.

The concept

Fractional-reserve banking is banking or monetary system, where a commercial bank only has to keep part of the bank deposits always available (liquid assets) as a reserve for disbursement. Bank reserves are held either as cash in the bank or as balances in the bank’s account at the central bank.

Well the rest of the deposited money can of course be lend, and become a credit. Some details might be important for careful reader:

- Legally, the deposited funds become the property of the commercial bank, and the customer in turn receives an asset called a deposit account. That deposit account is a liability on the balance sheet of the bank.

- Technically it means each bank can issue credits up to a specified multiple of its reserves.

So, we’re learning, the reserves amount can determine a lot for the banks, but also for the money available for lending. Therefore it’s the country’s central bank, who determines the minimum amount that banks must hold in s.c. liquid assets, called the reserve requirement or reserve ratio. That’s why mentioned Monetary policy as main duty of a Central Bank.

What happens in the bank run

The reserves only provide liquidity to cover withdrawals within the normal pattern. But there is a risk that customers may at any time collectively wish to withdraw cash out of their accounts in excess of the bank reserves - the bank run is happening. When depositors wish to withdraw more funds than the reserves held by the bank, the bank may borrow short-term funds at

- Interbank lending market.

- lender of last resort (LOLR)

LOLR will be used only in exceptional situations. LOLR is usually the central bank.

Reserve requirements

The commercial bank’s reserves normally consist of cash held by the bank and stored physically in the bank vault (vault cash), plus the amount of the bank’s balance in that bank’s account with the central bank. A bank is at liberty to hold in reserve sums above this minimum requirement, commonly referred to as excess reserves.

The reserve ratio is sometimes used by a country’s monetary authority as a tool in monetary policy. In the United States and many other countries (except Brazil, China, India, Russia), reserve requirements are generally not altered frequently in implementing a country’s monetary policy because of the short-term disruptive effect on financial markets.

Countries without reserve requirements

Canada, the UK, New Zealand, Australia, Sweden, Hong Kong have no reserve requirements.

In those countries banks are constrained by capital requirements, which are arguably more important than reserve requirements even in countries that have reserve requirements.

Reserve requirements by country

The minimum Reserve requirements examples listed below:

| Country | Reserve ratio (%) | Notes |

|---|---|---|

| USA | None | The FED reduced reserve requirement ratios to 0% effective on March 26, 2020 |

| Eurozone | 1.00 | |

| Poland | 0.50 | |

| Czech Republic | 2.00 | |

| Hungary | 2.00 | |

| South Africa | 2.50 | |

| Switzerland | 2.50 | |

| India | 3.00 | |

| Russia | 4.00 | |

| Pakistan | 5.00 | |

| Israel | 6.00 | |

| Lithuania | 6.00 | |

| Taiwan | 7.00 | |

| Romania | 8.00 | |

| Turkey | 8.50 | |

| Croatia | 9 | |

| Bulgaria | 10 | |

| Mexico | 10.50 | |

| China | 17.00 | |

| Tajikistan | 20.00 | |

| Brazil | 21.00 | |

| Lebanon | 30.00 |

Fractional-reserve banking is a system of banking operating in almost all countries worldwide or in other words, currently, no country in the world requires full-reserve banking across primary credit institutions.