Federal Funds rate: Overview

The Federal Funds Rate is the interest rate at which depository institutions (like banks and credit unions) lend reserve balances to other depository institutions overnight on an uncollateralized basis. Uncollateralized means that the loans made between depository institutions (like banks) do not require the borrower to provide collateral to the lender.

The Federal Funds Rate is critical in U.S. monetary policy as it serves as the benchmark for other short-term interest rates. It affects economic and financial conditions by influencing borrowing costs, economic activity, and ultimately the rate of inflation. The target for the rate is set by the Federal Open Market Committee (FOMC), which meets several times a year to discuss changes based on economic conditions.

The Federal Reserve sets a target range for the Federal Funds rate, and the actual rate is determined by market forces based on supply and demand for funds in the banking system. When the

Why is it range

The Federal Funds rate is set within a target range because it allows the Federal Reserve to have some flexibility in its monetary policy decisions. The target range is set by the Federal Open Market Committee (FOMC), which is the policy-making body within the Federal Reserve System.

The FOMC sets the target range based on its assessment of the current economic conditions and its outlook for future inflation and employment. The range is typically a half percentage point wide, and the midpoint of the range is considered the target rate.

By having a range instead of a single rate, the Federal Reserve can communicate its policy stance while still allowing for some variation in the actual interest rates that banks charge each other. This allows the Federal Reserve to respond to changes in economic conditions and adjust its policy stance as needed to achieve its dual mandate of promoting maximum employment and stable prices.

The range also provides some predictability and stability for financial markets, as investors and businesses can anticipate the likely direction of interest rates based on the Federal Reserve’s policy statements and actions.

HowFederal Funds Rate is actually achived technically?

As FED does not have the authority to directly control the lending behavior of individual commercial banks, including the interest rates they charge on interbank loans. While the Federal Reserve can set a target range for the Federal Funds rate, it cannot directly dictate the interest rates that banks charge on interbank loans. Interbank lending rates are influenced by a variety of factors, including supply and demand for funds, credit risk, and competition among banks.

So FED has to maintain the the key rates through other mechanisms, primarily involving open market operations and other tools that influence the supply of money and the conditions under which banks lend to each other.

Here in detail:

- Open Market Operations: The most common tool for FED. This involves the buying and selling of government securities in the open market. When the Fed buys securities, it increases the reserves of banks, making them more likely to lend at lower rates. Conversely, selling securities decreases bank reserves, pushing rates higher.

- Interest on Reserves: The Fed pays interest on excess and required reserves that banks hold at the Fed. By adjusting the rate of interest paid on these reserves, the Fed can influence the rates banks are willing to charge each other. If the interest on reserves is higher, banks are less likely to lend reserves at lower rates, thus helping to keep the Federal Funds Rate within the target range.

- Discount Window: This is the facility at which banks can borrow reserves directly from the Federal Reserve itself, typically at a rate higher than the upper limit of the Federal Funds target range. This rate, known as the discount rate, serves as a ceiling for the Federal Funds Rate, as banks are unlikely to borrow from each other at a higher rate than they would have to pay at the discount window.

- Repurchase Agreements: The Fed can also conduct repurchase agreements (repos), where it agrees to buy securities from banks with an agreement to sell them back at a later date. This temporarily adds reserves to the banking system, lowering the Federal Funds Rate. Conversely, reverse repos can be used to absorb reserves and increase the rate.

Breaking it down

How the Federal Funds rate works between two banks:

-

Banks are required to hold a certain amount of money in reserve to ensure they have enough funds to cover withdrawals and other transactions.

-

If a bank finds that its reserves are below the required level, it can borrow money from other banks that have excess reserves.

-

The borrowing bank contacts another bank to request a loan for an overnight period (i.e., until the next business day).

-

The lending bank reviews the borrowing bank’s creditworthiness and assesses the level of risk before agreeing to lend money.

-

The two banks agree on the interest rate at which the lending bank agrees to lend money to the borrowing bank. This becomes the effective federal funds rate (EFFR)

-

At the end of the day, the borrowing bank transfers the borrowed funds to the lending bank’s account at the Federal Reserve, along with interest charged by the lending bank.

-

The next business day, the borrowing bank repays the loan principal and interest to the lending bank.

-

The Federal Reserve tracks all transactions between banks and calculates the effective Federal Funds rate based on the weighted average of all transactions during the day.

-

The Federal Reserve can set a target range for the Federal Funds rate and use open market operations (buying or selling securities) to influence the actual Federal Funds rate toward its target rate.

This process of borrowing and lending between banks in the Federal Funds market helps ensure that banks have sufficient funds to meet their reserve requirements and facilitates the smooth functioning of the overall financial system.

The effective federal funds rate (EFFR)

The effective federal funds rate (EFFR) is calculated as the effective median interest rate of overnight federal funds transactions during the previous business day. It is published daily by the Federal Reserve Bank of New York.

The Federal Reserve enforces the effective Federal Funds rate through its open market operations, which involve buying or selling government securities in the open market.

If the Federal Reserve wants to lower the Federal Funds rate, it can buy government securities from banks, which increases the amount of reserves held by the banks and puts downward pressure on the Federal Funds rate. Banks now have excess reserves, which they can lend out to other banks at a lower interest rate, causing the Federal Funds rate to fall.

On the other hand, if the Federal Reserve wants to raise the Federal Funds rate, it can sell government securities to banks, which decreases the amount of reserves held by the banks and puts upward pressure on the Federal Funds rate. Banks now have fewer excess reserves, which makes it more expensive for them to borrow from other banks, causing the Federal Funds rate to rise.

Effective Fed Rate in the last 10 years

And next we see the effective Fed Rate in the boundaries of target range

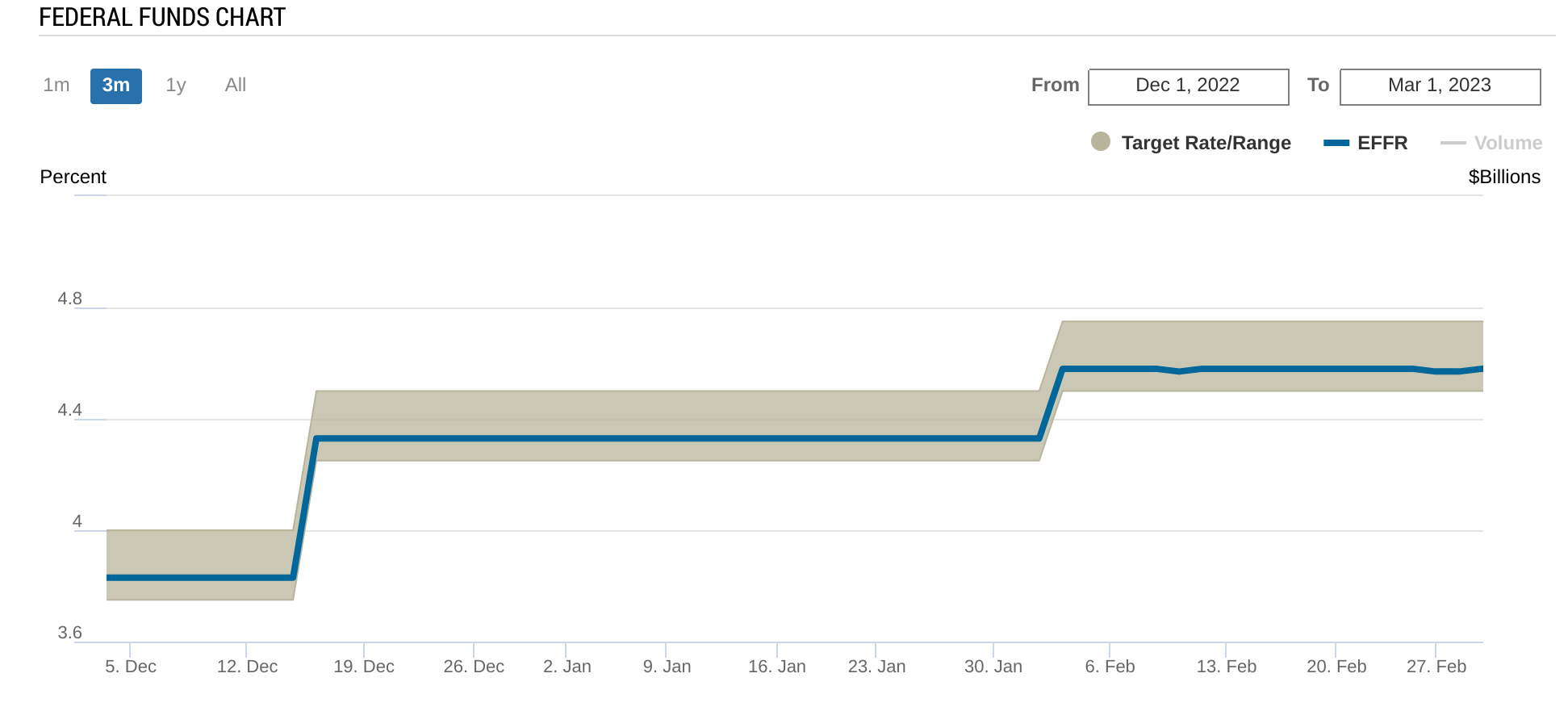

EFFR and target Fed Rate in the last 3 month

EFFR and target Fed Rate in the last 3 month

There is some beauty in this mechanism. It users the power of market. We can ask the question: can’t FED just forbid commercial banks to make inter banking loans outside of the target range ?

What is OBFR

The OBFR, or Overnight Bank Funding Rate, is released by the Federal Reserve Bank of New York, not the Federal Reserve itself. It is calculated as a volume-weighted median of overnight transactions in the unsecured interbank market, encompassing both federal funds and Eurodollars.

In contrast, the EFFR, or Effective Federal Funds Rate, is determined based on a volume-weighted median of overnight federal funds transactions among depository institutions. Notably, the OBFR is not a policy rate and is not directly managed by the Federal Reserve.