In the last article we have introduced Economic Sectors. In this article we’re going to get in the details of the energy sector.

Energy Sector intro

The Energy sector encompasses companies involved in the

- exploration

- production

- refining

- and marketing

of oil, gas, coal, and consumable fuels - the so called “Energy Commodities” Additionally also companies that offer related equipment, services, and energy business solutions.

Given its foundational importance, the Energy Sector significantly influences other sectors, from industrial manufacturing to consumer products, and holds a dynamic place in financial markets worldwide.

Energy sources

Fossil fuels are the most significant energy resources used in the Energy Sector. Companies in this sector are heavily involved in the extraction, refining, and distribution of these fuels.

- Crude Oil

- Natural Gas

- Coal

As the global energy sector pivots toward sustainability, many energy companies are increasing their investment in renewable energy sources. However the traditionally Energy Sector do not include pure Renewable Power Supply companies.

Economic Impact of the Energy Sector

Energy play the fundamental role in every industry and virtually every aspect of modern life. So the Energy Sector holds an outsized influence on the global economy. As of November 2024, the U.S. Energy Sector, as classified by GICS, has an estimated market capitalization of approximately $2.3 trillion.

It is estimated that in 2023 we have produced daily 96.4 million barrels, the price of daily crude oil would be $7.95 billion/day or $2.90 trillion a year.

Due to the fluctuating prices of oil, gas, and other fuels, the Energy Sector is closely monitored by investors and economists. Geopolitical tensions, supply disruptions, and changes in demand heavily impact oil prices, creating ripple effects in financial markets. The cost and availability of energy directly impact transportation, manufacturing, agriculture, and even tech sectors. Therefore, changes within the Energy Sector can have cascading effects across various industries.

Structure of the GICS Energy Sector

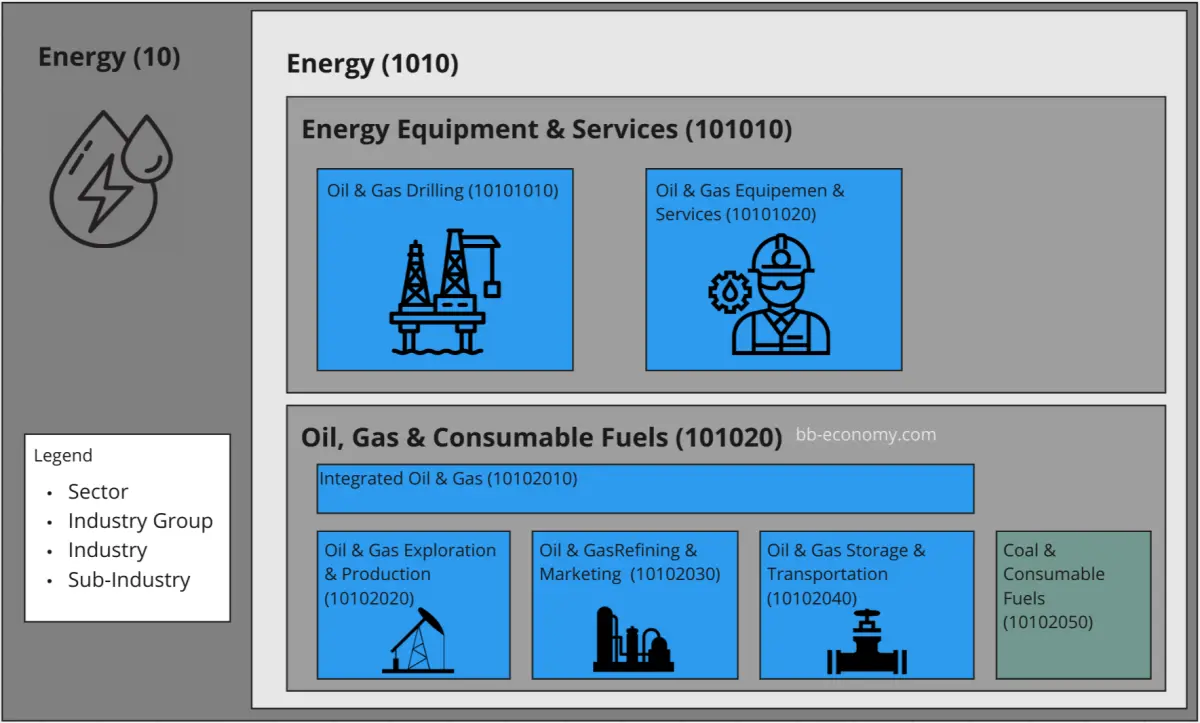

GICS divides Energy Sector 10 defines only one industry group 1010, but two Industries

- Energy Equipment and Services 101010

- Oil, Gas, and Consumable Fuels 101020

the industries are further broken down into sub industries.

Let’s deep dive into the Industry details

Energy Equipment and Services 101010

This industry group includes companies that provide support, technology, equipment, and services essential for the exploration, extraction, and production activities of the Oil, Gas, and Consumable Fuels industry. These companies do not produce energy directly but instead enable production. Core activities would include:

- providing drilling rigs

- well construction

- hydraulic fracturing

- seismic testing

- other technical services that allow exploration and production companies to access and process underground or offshore resources. Revenue is based on contracts and service fees with oil and gas companies (See 101020), making this industry indirectly affected by commodity prices.

This industry is special enough to mention most significant indexes that include companies from the Energy Equipment and Services (GICS Code: 101010) industry:

| Index Name | Ticker Symbol | Region | Description |

|---|---|---|---|

| Dow Jones U.S. Oil Equipment & Services | DJUSEQT | US | U.S. companies involved in oil and gas equipment and services, part of the Dow Jones |

| Philadelphia Oil Service Sector Index | OSX | US | Measures the performance of U.S.-listed oil service and equipment companies. |

| S&P Oil & Gas Equipment & Services Select Industry Index | US | Global index tracking the performance of major oil equipment and services firms. | |

| STOXX Europe 600 Oil & Gas Equipment | SXEP | Europe | European oil and gas equipment and services companies within the STOXX Europe 600 index. |

| Nasdaq U.S. Smart Oil & Gas Equipment | NOSSE | US | U.S. companies using a smart-beta strategy focusing on profitability and value. |

Oil and Gas Drilling (10101010)

This sub-industry consists of companies that own and operate rigs used for drilling oil and gas wells. Drilling companies are typically contracted by oil and gas exploration and production companies to extract these resources from various geological formations. Types of Drilling:

- Onshore Drilling: Conducted on land, it is often less complex and costly compared to offshore drilling.

- Offshore Drilling: Conducted in ocean environments and includes deep-water and ultra-deep-water drilling, which require specialized rigs and greater expertise.

List of the biggest drilling companies:

| Company Name | Ticker Symbol | Market Capitalization (USD) | Country | Summary |

|---|---|---|---|---|

| Noble Corporation plc | NE | $5.13b | UK | Contract drilling services with a focus on high-specification offshore drilling units. |

| Transocean Ltd. | RIG | $4.53b | CH | Offshore contract drilling services for oil and gas wells worldwide. |

| Patterson-UTI Energy, Inc. | PTEN | $4.07b | US | Operates land-based drilling rigs and provides pressure pumping services in North America. |

| Seadrill Ltd | SDRL | $3.52b | BM | Operates a fleet of offshore drilling rigs for oil and gas exploration and development. |

| Helmerich & Payne, Inc. | HP | $3.49b | US | Specializes in U.S. land drilling with a fleet of advanced rigs and drilling solutions. |

| Valaris plc | VAL | $2.50b | UK | Offshore drilling services across various water depths and geographies. |

| Borr Drilling Limited | BORR | $1.60b | BM | Owns and operates jack-up rigs for shallow-water drilling operations globally. |

| Diamond Offshore Drilling Inc. | DO | $1.20b | US | Operates offshore drilling rigs, including deepwater and ultra-deepwater units. |

| Precision Drilling Corporation | PDS | $990.7m | CN | Provides onshore drilling and related services primarily in Canada and the United States. |

| Nabors Industries Ltd. | NBR | $646.7m | BM | Offers drilling and drilling-related services for land-based and offshore oil and gas wells. |

we see that the capitalization is rather small in comparison to it’s sibling sub industry.

Oil and Gas Equipment and Services (10101020):

This sub-industry includes companies that provide products and services to the drilling and production processes, such as equipment manufacturing, maintenance, and technical support. Services include seismic testing, well construction, pressure pumping, hydraulic fracturing, cementing, completion, and maintenance of oil and gas wells. Equipment provided by these companies often includes components like pumps, valves, drill bits, and blowout preventers that are essential for the drilling process.

| Company Name | Ticker Symbol | Market Capitalization (USD) | Country | Summary |

|---|---|---|---|---|

| Schlumberger Limited | SLB | $67.62b | US | Provides technology for reservoir characterization, drilling, production, and processing to the oil and gas industry. |

| Baker Hughes Company | BKR | $34.37b | US | Integrated oilfield products, services, and digital solutions. |

| Halliburton Company | HAL | $29.91b | US | Products and services to the energy industry for exploration, development, and production of oil and natural gas. |

| Tenaris SA | TS | $17.40b | LU | Manufactures and supplies steel pipes and related services for the energy industry. |

| TechnipFMC plc | FTI | $11.20b | GB | Provides complete project life cycle services for the energy industry, including subsea, onshore/offshore, and surface projects. |

| Weatherford International | WFRD | $9.18b | US | Equipment and services for drilling, evaluation, completion, production, and intervention of oil and natural gas wells. |

| NOV Inc. | NOV | $7.32b | US | Designs, manufactures, and services equipment and components used in oil and gas drilling and production. |

| ChampionX Corporation | CHX | $6.16b | US | Provides chemistry solutions, artificial lift systems, and automation technologies for the oil and gas industry. |

| Tidewater Inc. | TDW | $5.03b | US | Operates a fleet of marine service vessels for the offshore energy industry. |

| Cactus, Inc. | WHD | $3.41b | US | Designs, manufactures, and sells wellhead and pressure control equipment for the oil and gas industry. |

Oil, Gas, and Consumable Fuels 101020

This industry encompasses companies involved in the exploration, production, refining, marketing, and distribution of oil, gas, and other consumable fuels (like coal and biofuels). Companies here are primarily focused on producing the actual energy commodities and getting them to the market. Core activities include drilling for crude oil and natural gas, refining oil into various fuels, and transporting and selling these products to end consumers. Thus Revenues are directly tied to commodity prices.

Integrated Oil & Gas (10102010)

Companies in this sub-industry called “integrated” because they cover the entire oil and gas supply chain, including exploring and drilling for crude oil, refining it into products like gasoline, and selling these products to consumers.

Here is the list of the biggest players.

| Name | Symbol | Capitalization | Country | Brief Description |

|---|---|---|---|---|

| Saudi Aramco | SAR | $1.74 t | SA | The world’s largest oil producer. |

| ExxonMobil | XOM | $497.62 b | US | A leading U.S.-based multinational oil and gas. |

| Chevron | CVX | $337.8 b | US | Every aspect of the oil, natural gas, and geothermal energy industries. |

| Shell plc | SHEL | $201.8 b | GB | A British-Dutch oil and gas. |

| TotalEnergies | TTE | $157.1 b | FR | Operates in all sectors of the oil and gas industry. |

| BP plc | BP | $105.3 b | GB | Oil and gas |

| Petróleo Brasileiro S.A. (Petrobras) | PBR | $93.82 b | BR | A Brazilian state-controlled, major player in the oil and gas industry in Latin America. |

| Equinor ASA | EQNR | $78.83 b | NO | A Norwegian multinational energy company, primarily a petroleum company but also has investments in renewables |

| Rosneft Oil Company | ROSN | $59.21 b | RU | Rosneft is the leader in Russia’s petroleum industry |

| PJSC Lukoil | LKOH | $52.60 b | RU | Lukoil is one of the largest global producers of crude oil |

| Suncor Energy Inc. | SU | $49.96 b | CA | Suncor specializes in production of synthetic crude from oil sands. |

| Eni S.p.A. | E | $48.5 b | IT | Oil and gas company. Eni operates in 66 countries. |

| Cenovus Energy Inc. | CVE | $36.37 b | CA | Cenovus is involved in oil sands projects and conventional oil and gas operations. |

| Ecopetrol S.A. | EC | $23.09 b | CO | The largest and primary petroleum company in Colombia |

| Repsol S.A. | REPYY | $19.2 b | ES | Worldwide upstream and downstream activities. |

| OMV Aktiengesellschaft | OMVKY | $15.6 b | AT | Oil, gas |

One should not wounder this sub industry is defining the whole sector.

Oil & Gas Exploration and Production (E&P) (10102020)

The resource hunters. Focused on the “upstream” part of the supply chain, E&P companies locate oil and gas reserves and drill wells to extract these resources.

| Name | Symbol | Capitalization | Country | Brief Description |

|---|---|---|---|---|

| ConocoPhillips | COP | $133.63 b | US | Crude oil, natural gas, and natural gas liquids. |

| Canadian Natural Resources | CNQ | $76.28 b | CA | Crude oil, natural gas, and natural gas liquids, with operations in North America, the North Sea, and Offshore Africa. |

| EOG Resources | EOG | $71.80 b | US | Crude oil, natural gas, and natural gas liquids, primarily in the United States. |

| Occidental Petroleum | OXY | $55.26 b | US | Operates in United States, the Middle East, Colombia |

| Pioneer Natural Resources | PXD | $53.57 b | US | Crude oil, natural gas particularly in the Permian Basin in Texas |

| Hess Corporation | HES | $45.97 b | US | Crude oil, natural gas with operations primarily in the United States and Guyana. |

| Novatek | NVTK | $36.88 b | RU | Largest independent natural gas producer in Russia. |

| Woodside Energy Group | WDS | $36.80 b | AU | Crude oil, natural gas, and natural gas liquids, with a focus on LNG. |

| Diamondback Energy | FANG | $36.30 b | US | Onshore oil and natural gas reserves in the Permian Basin in West Texas. |

| Devon Energy | DVN | $29.72 b | US | Exploration in the United States, focusing on onshore oil and gas production. |

| EQT Corporation | EQT | $22.39 b | US | EQT’s operations are centered on the efficient and responsible development of its extensive natural gas assets. |

| Marathon Oil Corporation | MRO | $15.40 b | US | Expected to be Aquired byConocoPhillips |

Oil & Gas Refining and Marketing (R&M) (10102030)

These companies refine crude oil into usable products like gasoline, diesel, and jet fuel, then market and sell them to businesses and consumers (gas stations, airports, and businesses).

| Name | Symbol | Capitalization | Country | Brief Description |

|---|---|---|---|---|

| Marathon Petroleum Corporation | MPC | $61.65 billion | US | Operates the US largest refining system. 13 refineries and approximately 2.9 million barrels per day. |

| Phillips 66 | PSX | $59.51 billion | US | A diversified energy. 13 refineries with a net crude oil capacity of 2.2 million barrels per day globally. |

| Valero Energy Corporation | VLO | $52.22 billion | US | An international manufacturer. Valero operates 15 petroleum refineries. |

| Polski Koncern Naftowy ORLEN | PKN | $20.05 billion | PL | A major Polish oil refiner and petrol retailer, ORLEN operates in Central Europe and Canada. |

| Formosa Petrochemical Corp | 6505 | $19.13 billion | TW | Engaged in refining crude oil, producing petrochemical products, and operating gas stations. |

| ENEOS Holdings, Inc. | 5020 | $15.56 billion | JP | A Japanese petroleum and metals conglomerate. |

| Neste Oyj | NESTE | $14.74 billion | FI | Neste is a leading producer of renewable diesel and sustainable aviation fuel. |

| Türkiye Petrol Rafinerileri A.Ş. (Tüpraş) | TUPRS | $10.27 billion | TR | The largest oil refiner in Turkey. Operates four refineries. |

| Idemitsu Kosan Co., Ltd. | 5019 | $8.92 billion | JP | Engaged in oil refining & distribution and renewable energy. |

| Sunoco LP | SUN | $7.59 billion | US | focused on the distribution of motor fuels to independent dealers, commercial customers, and distributors. |

Oil & Gas Storage and Transportation (10102040)

The oil and gas industry is usually divided into three major components: upstream, midstream and downstream. The midstream sector involves the transportation (by pipeline, rail, barge, oil tanker or truck), storage, and wholesale marketing of crude or refined petroleum products. These companies are like supply chain managers. The focusing on logistics of moving and storing oil and gas, using pipelines, storage tanks, and ships.

| Name | Symbol | Capitalization | Country | Brief Description |

|---|---|---|---|---|

| Enbridge Inc. | ENB | $80.12 billion | CA | Operates the world’s longest crude oil and liquids transportation system. |

| Kinder Morgan, Inc. | KMI | $44.55 billion | US | Energy infrastructure company, specializes in owning and controlling oil and gas pipelines and terminals. |

| TC Energy Corporation | TRP | $42.36 billion | CA | Operates energy infrastructure in North America, including pipelines and power generation assets. |

| Enterprise Products Partners L.P. | EPD | $58.92 billion | US | Midstream energy services, operates pipelines, storage facilities, and terminals. |

| Williams Companies, Inc. | WMB | $36.45 billion | US | Focused on natural gas processing and transportation, with operations in the United States. |

| ONEOK, Inc. | OKE | $29.75 billion | US | Engaged in the processing, storage, and transportation of natural gas and natural gas liquids. |

| Cheniere Energy, Inc. | LNG | $27.80 billion | US | Engaged in LNG related businesses, including LNG terminals and pipelines. |

| Plains All American Pipeline, L.P. | PAA | $8.92 billion | US | Engaged in pipeline transportation, marketing, and storage of crude oil and refined products. |

| Magellan Midstream Partners, L.P. | MMP | $10.15 billion | US | Stores and distributes refined petroleum products and crude oil. |

| Pembina Pipeline Corporation | PPL | $21.50 billion | CA | Midstream services for the energy industry, including pipelines and gas gathering systems. |

Coal & Consumable Fuels (10102050)

Companies in this segment produce coal and other solid fuels for electricity generation and industrial use.

| Name | Symbol | Capitalization | Country | Brief Description |

|---|---|---|---|---|

| China Shenhua Energy | 601088.SS | $109.49 billion | CN | The largest coal mining company in China. |

| Glencore | GLCNF | $63.96 billion | CH | Glencore is a major producer and marketer of coal, among other minerals and metals. |

| Coal India | COALINDIA.NS | $32.48 billion | IN | State-controlled coal mining company. The largest coal-producing company in the world. |

| Yankuang Energy (Yanzhou Coal Mining) | 600188.SS | $18.66 billion | CN | mining, preparation, and sale of coal, as well as the production of methanol and electricity. |

| Washington H. Soul Pattinson and Company (Soul Patts) | SOL.AX | $7.94 billion | AU | investment company including significant investments in coal mining through its subsidiary, New Hope Corporation. |

| Adaro Energy | ADRO.JK | $7.67 billion | ID | operations in South Kalimantan. |

| United Tractors | UNTR.JK | $6.30 billion | ID | engaged in heavy equipment distribution, mining contracting, and coal mining. |

| Yancoal | YAL.AX | $5.71 billion | AU | diversified product mix of metallurgical and thermal coal. |

| Whitehaven Coal | WHC.AX | $3.76 billion | AU | operating in New South Wales, producing both metallurgical and thermal coal. |

| Warrior Met Coal | HCC | $3.42 billion | US | producer and exporter of metallurgical coal for the global steel industry, operating in Alabama. |

Most relevant Indexes for the Energy Sector

| Index Name | Ticker Symbol | Region | Description |

|---|---|---|---|

| S&P 500 Energy Index | SPN | U.S. | companies within the S&P 500, including oil, gas, and consumable fuels companies. |

| Dow Jones U.S. Oil & Gas Index | DJUSEN | U.S. | U.S.-listed oil and gas companies |

| NYSE Arca Oil & Gas Index | XOI | U.S. | CU.S.-listed companies involved in oil and gas |

| Russell 3000 Energy Index | RU0ENG | U.S. | U.S. energy sector companies within the Russell 3000, |

| FTSE 350 Oil & Gas Index | NMX0530 | United Kingdom | UK-based oil and gas companies within the FTSE 350 |

| Stoxx Europe 600 Oil & Gas Index | SXEP | Europe | European oil, gas, and consumable fuels companies, part of the Stoxx Europe 600. |

| MSCI World Energy Index | MXWR0EN | Global | Worldwide, focusing on oil, gas, and consumable fuels. |