Energy Commodities Overview

Energy commodities such as crude oil, natural gas, and coal are the backbone of the global economy, powering everything from industrial machinery to household appliances. As the world grapples with energy transitions and market volatility, these commodities remain pivotal to economic stability and growth. Investors and policymakers alike rely on stock market tools—futures contracts, indexes, and ETFs—to navigate the complexities of energy markets, hedge risks, and capitalize on emerging opportunities. Take a deeper look on the Energy Sector.

Broadly, energy commodities fall into two main categories:

-

Fossil Fuels: Crude oil, natural gas, and coal. Fossil fuels are the dominant sources of global energy.

-

Renewable Energy Commodities: renewable resources such as solar and wind energy credits. These commodities are becoming increasingly important, but still not defining atm.

The Petroleum

The term petroleum refers both to naturally occurring unprocessed crude oil.

In the last decade, the world has produced approximately 350 billion barrels of petroleum, averaging around 35 billion barrels annually. Daily global petroleum production fluctuated between 80 and 100 million barrels per day, peaking at over 100 million barrels in 2019 before declining sharply in 2020 due to the COVID-19 pandemic. Production has since recovered, driven by increased demand and expanded capacities in countries like the United States, Saudi Arabia, and Russia. Despite temporary downturns, oil production has remained a cornerstone of global energy supply.

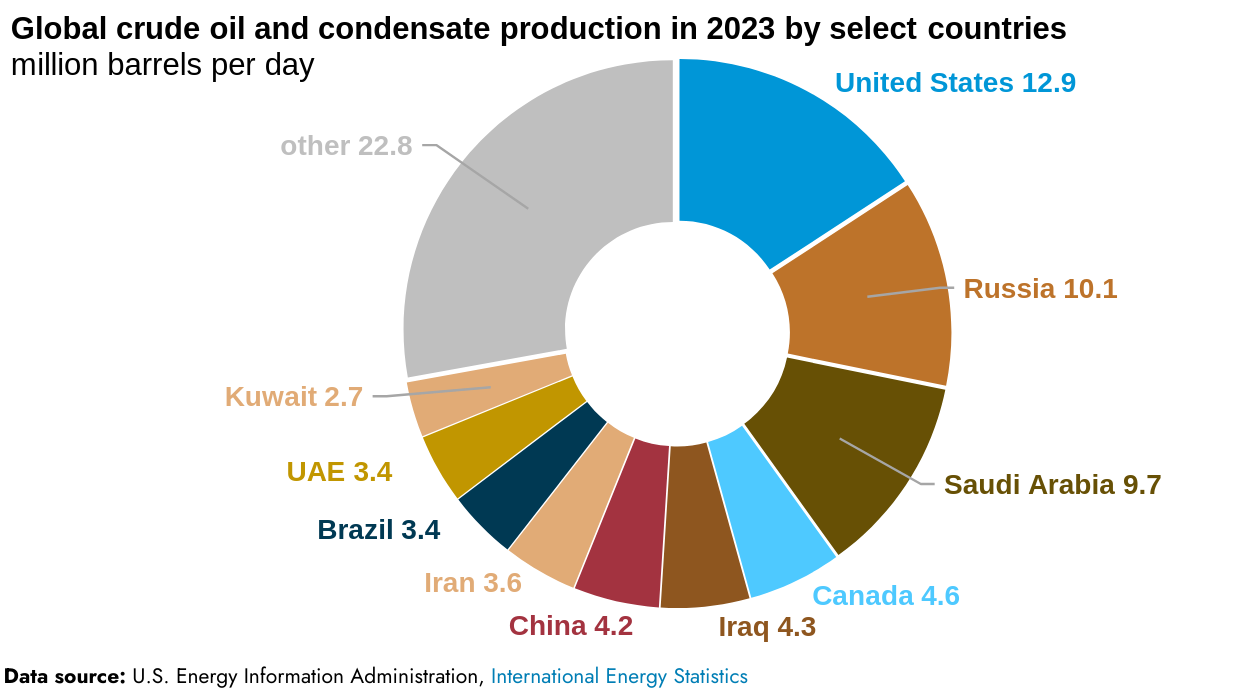

Petroleum production buy country

The U.S. Tops Global Crude Oil Production.

USA, Russia, and Saudi Arabia are together producing about 1/3 of worlds production - 32.7 million barrels per day in 2023.

Data from the U.S. Energy Information Administration (EIA).

Data from the U.S. Energy Information Administration (EIA).

Petroleum Consumption buy country

the top five petroleum-consuming countries and their respective shares of global oil consumption are:

2021

- 20.4% USA

- 15.7% China

- 4.8% India

- 3.8% Russia

- 3.5% Japan

2023

- 20% USA

- 15% China

- 5% India

- 4% Russia

- 4% Saudi Arabia

Crude oil classification

WTI - West Texas Intermediate

West Texas Intermediate (WTI) oil grade is also known as Texas light sweet. WTI is a benchmark for U.S. crude oil pricing, primarily produced in the Permian Basin, which spans western Texas and southeastern New Mexico. In August 2024, U.S. oil production reached a record high of 13.4 million barrels per day (bpd), with Texas contributing 5.82 million bpd and New Mexico 2.09 million bpd.

Regarding exports, U.S. crude oil shipments have been increasing. In 2023, exports averaged over 4 million bpd, with Europe and Asia being significant destinations. This growth is attributed to expanded infrastructure and rising global demand for U.S. crude. The Gulf Coast, particularly Texas, serves as the primary hub for these exports, facilitated by a network of pipelines, storage facilities, and export terminals.

- Density: light (Between 37 and 42 degrees API gravity)

- Sulfur amount: sweet (low sulfur), Typically below 0.42%.

- Location: Oil produced from any location can be considered WTI if the oil meets the required qualifications

- Futures: Futures contract traded on NYMEX (the New York Mercantile Exchange ), Represents 1,000 barrels of crude oil

- Delivery Point Cushing, Oklahoma (The hub)

- Ticker CL, Ticker Example: CLZ24 (indicating a December 2024 contract).

WTI Infrastructure Details

Today, Cushing has grown to become the key nexus for the global crude oil market, with over 30 inbound and outbound pipelines and 16 major storage terminals. Many industry sources cite Cushing shell capacity in excess of 100 million barrels.

Key Pipelines: Cushing –> Houston area (Harbors: Freeport, Texas City)

- Seaway Crude Pipeline System (SCPS):, capacity of 950,000 barrels per day (b/d). Operator is Enterprise Products Partners (EPS)

- Keystone MarketLink: Cushing –> Houston area 700,000 b/d capacity from Cushing to Houston. Operated by TC Energy

- Cushing South: 120,000 b/d

Key crude oil pipelines inbound to Cushing:

- Flanagan South (Canada/Bakken) 660,000 b/d , Operator Enbridge

- Keystone (Canada / from Steele City, NE) 590,000 b/d, Operator TC Energy

- Basin Pipeline. From Permian, 450,000 b/d Plains

Major export terminals operated by companies like Enterprise Products Partners and Enbridge have been instrumental in handling the increased export volumes. For instance, Enterprise received a license to develop the Sea Port Oil Terminal (SPOT) in Texas, capable of loading Very Large Crude Carriers (VLCCs) with up to 85,000 barrels per hour.

These developments have solidified the Gulf Coast’s role as a central hub for WTI crude oil exports, meeting the growing global energy needs.

Brent Crude

Brent crude, sourced from the North Sea, serves as a key benchmark for the global oil market, with its pricing influencing more than two-thirds of the world’s crude oil contracts. Its strategic location and pipeline infrastructure have made it a cornerstone of international energy trading.

The original Brent Crude referred to a trading classification of sweet light crude oil first extracted from the Brent oilfield in the North Sea in 1976. As production from the Brent oilfield declined to zero in 2021, crude oil blends from other oil fields have been added to the trade classification.

In 2023, the Brent benchmark began including Midland, Texas oil from the Permian Basin to

- Diversify Supply: The North Sea’s oil production is in long-term decline. By adding Midland crude, Brent can maintain its liquidity and relevance as a global benchmark.

- Meet Global Demand: The inclusion of Midland crude reflects the increasingly interconnected global oil market, where U.S. crude exports are becoming a significant component.

- Maintain Quality Standards: Midland crude is of similar quality to the existing Brent basket, with a low sulfur content and light density.

While Midland oil originates in the Permian Basin associated with WTI, its inclusion in the Brent basket relates to its delivery mechanism and market role. Also Midland oil that qualifies for the Brent basket must be waterborne—exported via Gulf Coast terminals to international markets, rather than traded domestically through pipelines and storage hubs like Cushing. This distinction separates Midland crude included in Brent pricing from WTI crude traded domestically.

Petroleum Usage

Petroleum is a versatile and essential resource with a wide range of applications across various sectors. According to U.S. Energy Information Administration, The percentage share of total U.S. petroleum consumption by major end-use sectors in 2022 was:

- 66.6% Transportation

- 27.5% Industrial

- 2.8% Residential

- 2.5% Commercial

- 0.6% Electric Power

Globally those numbers look as following

1. Transportation

- About 60% of global oil consumption is used in the transportation sector. Oil is refined into gasoline, diesel, and jet fuel, which power cars, trucks, airplanes, ships, and trains. Key Products:

- Gasoline for cars.

- Diesel for trucks and heavy vehicles.

- Jet fuel for aircraft.

2. Petrochemical Industry

- 10-15% of global oil is used petrochemical sector consumes around . Key Products:

- Plastics: Oil derivatives are used to manufacture plastics, which are critical in packaging, construction, and consumer goods.

- Chemicals: Oil is a base for many industrial chemicals, including solvents, fertilizers, and synthetic fibers.

- Pharmaceuticals: Oil-derived products are used in drug manufacturing and medical equipment.

4. Energy Production

- About 5-10% of oil consumption is for electricity and heating. Key Usage:

- Electricity Generation: In some regions, oil is burned to produce electricity, especially where other energy sources are less accessible.

- Heating: Heating oil is used to warm buildings in colder climates.

4. Industrial Uses

Globally, a significant portion of petroleum is used for industrial applications such as the production of lubricants, asphalt, and petrochemical feedstocks. 20-30% of total petroleum consumption worldwide.

- Lubricants: Oil-based lubricants are vital for machinery and equipment. Around 1-2% of total global petroleum consumption is used to produce lubricants

- Asphalt: Crude oil byproducts are used to make asphalt for roads and infrastructure. About 2-3% globally.

- Around 12-15% of global petroleum consumption, is used to produce petrochemical feedstocks. Those are raw materials for creating plastics, synthetic fibers, fertilizers, solvents, and other industrial chemicals. These products play a critical role in manufacturing and modern life.

5. Non-Energy Uses

- Agriculture: Oil-based products are used in fertilizers, pesticides, and machinery fuel.

- Consumer Goods: Everyday items like cosmetics, synthetic clothing, and household products are derived from oil.