Stocks to watch

Please keep in mind This is not investment advice!

Stocks to watch:

| Symbol | Interesting Price level | Comment |

|---|---|---|

| UNG | $6.5-7 | United States Natural Gas Fund, LP - Gas Futures ETF. Please don’t rush. |

| MMM | $100 | |

| TSN | $56.7 | Support. But resistance at 61.8?+ |

| DIS | $90 | |

| M | $16 | |

| TDOC | $22.50 | |

| PFE | $40 | |

| LUMN | $2,5 | |

| DDOG | $65 | Below this becomes attractive. |

| PYPL | $72 | |

| VNO | $13 |

AAP details

In the last week predictions we made a point of watching the (AAP).

The strong downtrend pivoted at $110 as we indicated. Well not its very much possible that the trends sustains as long the whole marked positive trend sustains.

First quarter end

The first quarter of 2023 ended higher very solid as a second quarter in row. Last days showed very dynamic grown in als sectors, while tech and growth part outgrowth the average. It’s yet to early to predict if this trend can sustain and last in april. Markets are not decides if we will have another 25pb Fed rate hike on 3 May, but markets are very confident that Fed will start lower the rates in 2023. This sounds liquidity! for the markets and especially tech and Nasdaq is taking it all very bullish.

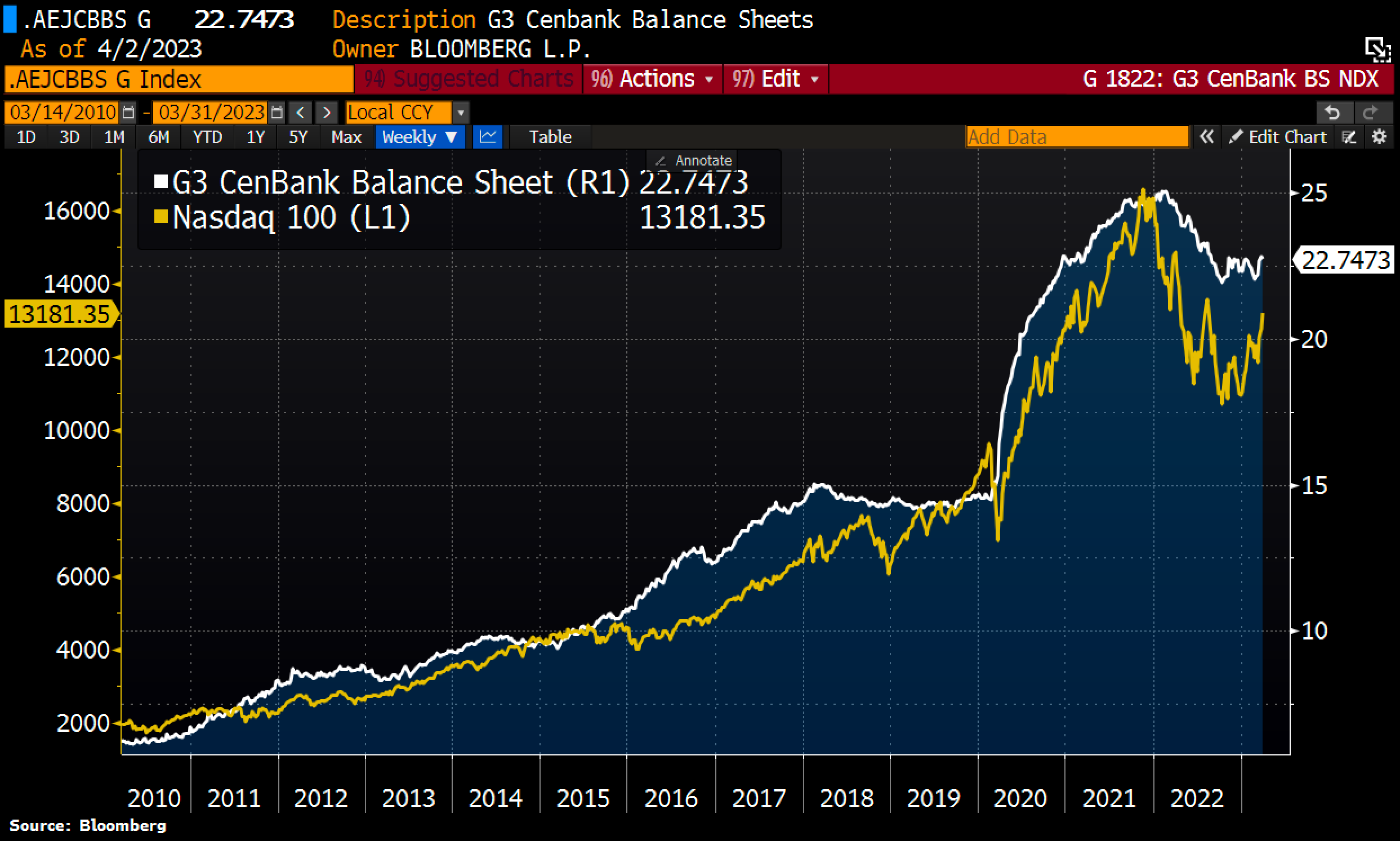

Just look at this plot

Nasdaq 100 + the combined balance sheet Amounts of the Fed, ECB, and Bank of Japan

However the recent Bunk Runs and fear about collapsing banking sector is just a couple weeks old and even small events can fuel the sentiments in this topic again. On the other hand any problem in the banking will make it harder for FED to hike Funds rate.

Should you be interested in the development of the reginal banks, watch the following: KRE, GNW, WAL, FRC, ZION, AIG, MET, SCHW

Monetary stats

| Rates | Value (%) |

|---|---|

| Fed Funds rate (range) grown on 22.03 | 4.75-5.00 |

| EFFR | 4.83 |

| Fed Discount Rate | 5.00 |

| Prime rate | 8.00 |

Next week Calendar:

Monday, April 3

- OPEC+ Virtual Meeting

Earnings Reports:

- Science Applications (SAIC)

- Digital Ally (NASDAQ:DGLY).

Statistical Data:

- S&P Global Manufacturing PMI - Final Reading (Mar)

Tuesday, April 4

Statistical Data:

- JOLTS Job Openings (Feb)

- Germany: Balance of Trade

Wednesday, April 5

Earnings Reports:

- Conagra Brands (CAG)

- Simply Good Foods (SMPL)

- Seadrill Limited (SDRL)

Statistic Data:

- U.S Balance of Trade

- ISM Non-Manufacturing PMI

Thursday, April 6

Earnings Reports:

- Levi Strauss (LEVI)

Friday, April 7

- U.S. Unemployment Rate