Lastly we have covered the Money Supply. In this article we would like to explore How the Money Supply theory affect stocks markets and also investors.

Recap

Money Supply influences the stock market by altering liquidity and interest rates in the economy.

- Increasing Money Supply: When central banks inject more money, it lowers interest rates, making borrowing cheaper. This boosts corporate profits, consumer spending, and investment, often driving stock prices higher. However, excess liquidity can lead to asset bubbles.

- Decreasing Money Supply: Tightening reduces liquidity and raises interest rates, discouraging borrowing and spending. This can lower corporate earnings and investor confidence, often causing stock market declines.

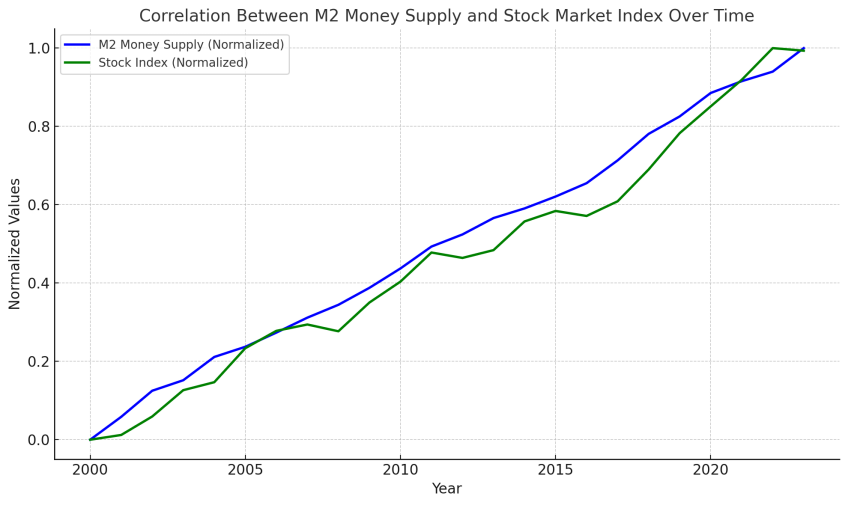

So the normalized correlation between the US Money Supply (M2) and US Stock market between 2000 and 2020 as shown below:

Let me provide some more theoretical details why is this happening:

The real economy theory

The indirect stock marked influence can be described like this. When Money Supply increases, then businesses have more for their investments, to expand or to improve their products and services. When consumers have more money, they’re able to buy more of these products and services. All together helps the economy to flourish and to grow the business earnings. An increase in earnings makes businesses more attractive and is seen in the growing stock prices.When money supply is decreased, the cycle is reversed, eventually leading in a decrease in stock prices.

The stock marked supply theory

Well, the real economy Money Supply theory as Stock Marked has it limitation, otherwise all the Central Banks of the world would constantly increase Money Supply to let the economy flourish non stop. Ok, after Covid its seemed like the Central Bank chefs have been doing exactly this - but this is another story. ;)

However, when Money Supply increases it’s the Commercial Bank Money that is primarily created. And it’s created by credits being lend not only to real economy sector business, but any kind of private or institutional actors. Especially when the interest are low, a significant and maybe even dominant portion of that money can very soon land in the stock market bypassing real economy.

Pandemic Money Printing

Just to stay in example. After the Covid-19 economy shutdowns in the years 2020-2021 across the world, the global economy slowed down (and locked itself for the following years by the supply chains crisis), central banks reacted with enormous increase in Money Supply like never before. Interest rates fell to historic lows and we see what this did to the stock market. Since the bottom of the market on March 23rd of 2020, the S&P 500 has grown more than 120% until Jan 2023 or 42% to pre Covid hights. Nasdaq 141 and 70 respectively. This grow rates cannot be explained wit real economy growth of course. And since January 2023 the stock markets are falling world wide after the FED began to decrease Money Supply because of grown inflation.