Phases of a Economic Bubble

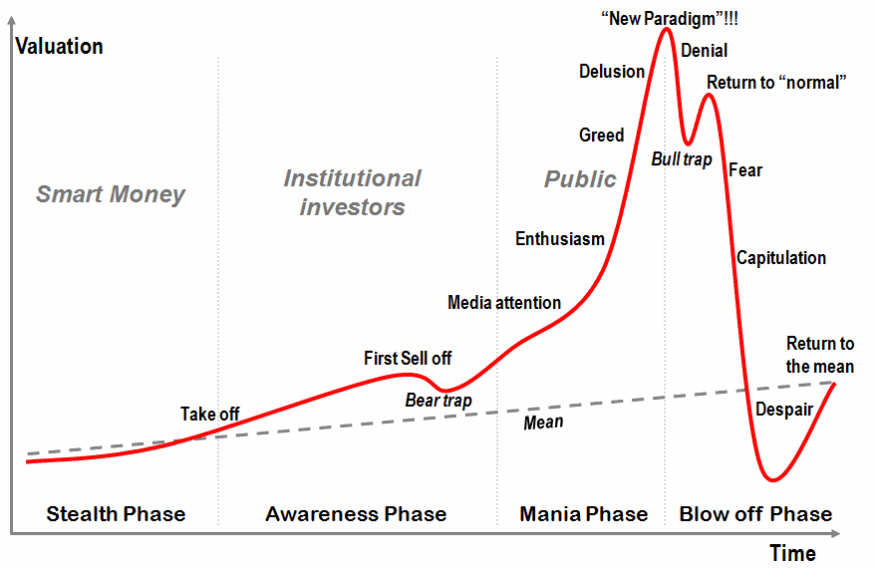

Jean-Paul Rodrigue achieved notability with his model of economic bubbles, charting four “phases of a bubble”.

Bubbles (financial manias) unfold in several stages, an observation that is backed up by 500 years of economic history. For simplistically, four phases can be identified:

TLDR

While the “smart money” has purchased during the earlier “stealth phase”, institutional investors begin to buy during “take off”. Following media coverage, the general public begins to invest leading to steep rise in prices as “enthusiasm” and then “greed” kick in. “Delusion” precedes the peak.

Phase Details

- Stealth. Those who understand the new fundamentals (Smart Money) realize an emerging opportunity for substantial future appreciation. In this phase those investors buy some asset class, often quietly and cautiously. They can also rely on speculative and unproven assumptions. Prices gradually increase but often go completely unnoticed by the general population. Larger and larger positions are established as the smart money starts to understand better that the fundamentals are well-grounded and that this asset class is likely to experience significant future valuations.

- Awareness. Many investors start to notice the momentum, bringing additional money in and pushing prices higher. There can be a short-lived sell-off phase (or several of those) taking place as a few investors cash in their first profits. The Smart Money takes this opportunity to reinforce its existing positions. In the later stages of this phase, the media starts to notice and to produce positive reports.

- Mania. Everyone is noticing that prices are going up, and the public jumps in. The expectations about future appreciation become a “no brainer,” and a linear inference mentality sets in. This phase is not about logic but a lot about psychology. A lot of money come in, creating even greater expectations and pushing prices to stratospheric levels and the craziness is, that the higher the price is, the more investments pour in. The smart money, as well as many institutional investors, are quietly pulling out and selling their assets. Unbiased opinion about the fundamentals becomes increasingly difficult to find as many players are heavily invested and have every interest to keep asset inflation going. The market gradually becomes more exuberant as “paper fortunes” are made from regular “investors,” and greed sets in. Everyone tries to jump in, and new intrants have absolutely no understanding of the market, its dynamic, and fundamentals. Prices are bid up with all financial means possible, particularly leverage and debt. If the bubble is linked with lax sources of credit, then it will endure far longer than many observers would expect, therefore discrediting many rational assessments that the situation is unsustainable. At some point, statements are made about entirely new fundamentals implying that a “permanent high plateau” has been reached to justify future price increases - the bubble is about to collapse.

- Blow-off A moment of epiphany (a trigger) arrives, and everyone roughly at the same time realizes that the situation has changed. Confidence and expectations encounter a paradigm shift, not without a phase of denial- where many try to reassure the public that this is just a temporary setback. Some are fooled, but not for long. Many try to unload their assets, but takers are few. Everyone is expecting further price declines. The house of cards collapses under its own weight, and latecomers (commonly the general public) are left holding depreciating assets while the smart money pulled out a long time ago. Prices plummet at a rate much faster than the one that inflated the bubble. Many over-leveraged asset owners go bankrupt, triggering additional waves of sales. There is even the possibility that the valuation undershoots the long-term mean, implying a significant buying opportunity. However, the general public at this point considers this sector as “the worst possible investment one can make”. This is the time when the smart money starts acquiring assets at low prices.

Economic bubble accourdind to Hyman P. Minsky

American economist Hyman P. Minsky classify five Phases of an Economic Bubble.

-

Displacement - The beginning phase when the investors start noticing a new paradigm in the market. This is basically done to grab their attention and can be anything like a product or technology.

-

Boom is the phase where prices start to rise. The market gets more momentum in this phase as more investors are attracted. And, thus it causes more people to buy assets.

-

Euphoria is the zenith stage of an economic bubble. When euphoria occurs when asset prices rise steeply. After this step, the investors are moved out of the frame.

-

The profit taking advantage is only for the persons who identify the early warning signs and make money only who can identify early warning signs that can make profits by selling off positions.

-

Panic is the final stage of an economic bubble. It is a decline in economics. It is the phase when the price of a commodity drops as rapidly as it has risen. When supply outshines the demand, the decline can be observed, and in such cases all the investors want is to liquidate the commodity at any price.

The psychology behind Economic Bubbles

There are many psychological factors that lead to the build of a bubble, and many are still not known. Here is a list of the most prevalent problems we see when dealing with behavioral finance and theories of why economic bubbles occur.

- Herd mentality – as humans, we always want to follow the crowd, especially if we hope for a positive expected outcome.

- Fear-of-missing-out – The fear of missing something that could make a life better is a big driver of first investors.

- Short-term thinking – All other aspects are shut out as long as the investor thinks that he can “beat the market”. This also increases the likelihood of high risk-taking investment decisions.

- Confirmation Bias – Humans tend to only hear what they want to hear.

- Overconfidence & “Illusory Superiority” – When we win, it’s talent and when we lose, it’s bad luck.

- Greater fool theory – This theory describes aspects of a late-stage bubble. Where people pay huge sums for already overvalued assets and believe that they will find a “greater fool” who will buy it for even more money.